3 min read

Health insurance agents: People will buy for their reasons, not yours

We’ll give you a pass if your first fall with Medicare’s Annual Election Period or the Marketplace’s Open Enrollment Period didn’t meet your sales...

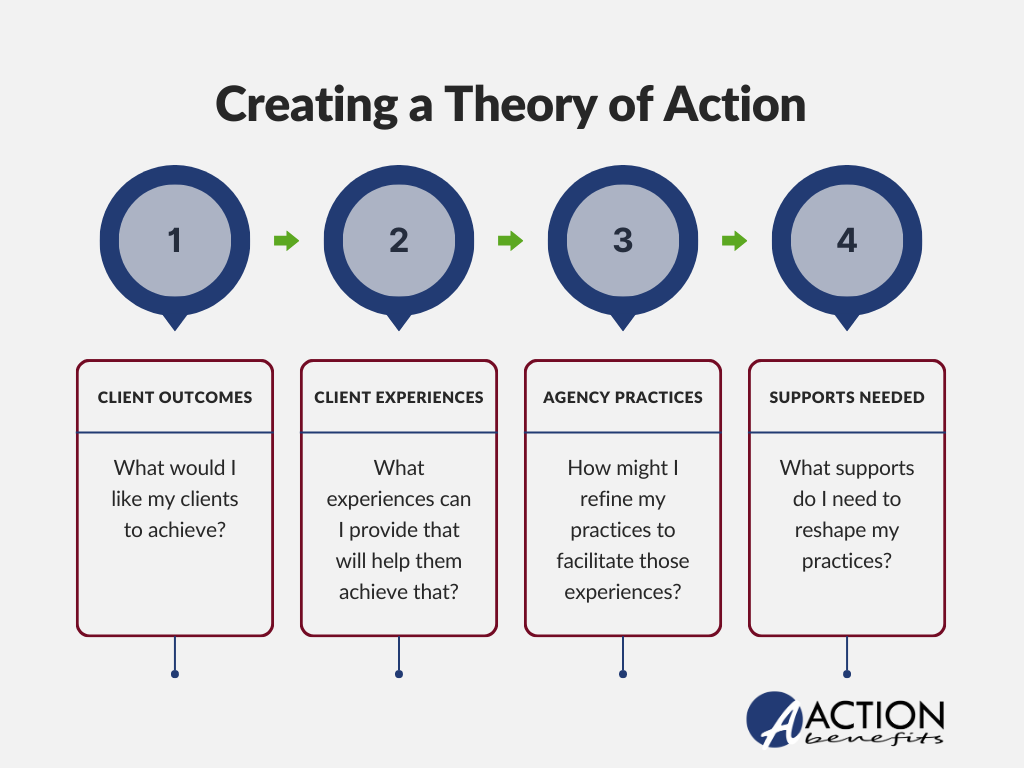

A new year brings new opportunities, presenting an important chance to take stock of your agency’s progress. You likely have an established process for setting (and achieving) your sales, marketing, and operational goals. If you find yourself falling short of those goals, however, it could be because you’re focusing on something your clients don’t necessarily care about – the success of your health insurance agency. Shifting your thinking to put clients first will provide the spark you need to supercharge your sales.

The most successful agents put their client outcomes first. Start by focusing on what, exactly, you’d like your clients to achieve. This might seem like a superficial step, but committing these outcomes to paper puts you in a position to better meet these goals. Your client outcomes could look like any of these:

Each of these outcomes puts your clients at the center – and compels you to carefully consider how you’ll achieve them. This brings us to…

If you’re going to deliver on those outcomes, you’ll need to design client experiences that help you achieve them. Let’s think for a moment about what types of client experiences could yield the above outcomes.

Thinking about your client outcomes prompts you to examine the experiences you deliver. If you’re going to enhance those experiences, though, you’ll need to spend some time examining your own actions.

You’ve got the perfect client experience in mind. What do you need to do to help deliver that experience? In short, the experiences you want to deliver should inform adjustments to how you do business.

Some adjustments are easier to make than others. For the ones that seem more difficult, you’ll need to find the resources and supports to make that change possible.

Changing even small things about the way you do business is never easy. You’ll need to identify the right resources to support that change.

Creating a theory of action starts by putting your clients at the center and ends with you identifying the support needed to best serve your clients. As you locate those supports and adjust your own behaviors, you’ll deliver even better client experiences. And when clients have great experiences with you, you’re guaranteed to build a lasting business relationship.

Give the process a try. Download a guide here.

3 min read

We’ll give you a pass if your first fall with Medicare’s Annual Election Period or the Marketplace’s Open Enrollment Period didn’t meet your sales...

4 min read

Particularly with Medicare plans, hospital costs are being passed on to your clients more now than ever. And because a hospital stay or a dread...

3 min read

So you get your client onboarded. He has his card, his summary of benefits--He is thrilled with his coverage. He even emailed a nice thank you note....