2 min read

AEP 2026: The year of the Medicare Advantage disruption

The plans, they are a changin’ The Medicare Advantage market has been shaken up all across the country, but particularly so in Michigan, and even...

6 min read

Action Benefits

Updated on July 30, 2025

Action Benefits

Updated on July 30, 2025

| Year | Bid Amount | Year-over-Year Change | Market Impact |

|---|---|---|---|

| 2023 | $34.71 | — | Pre-IRA Baseline |

| 2024 | $64.28 | +85.2% | Initial IRA Impact |

| 2025 | $179.45 | +179.2% | Major Restructuring |

| 2026 | $239.27 | +33.3% | Continued Adjustment |

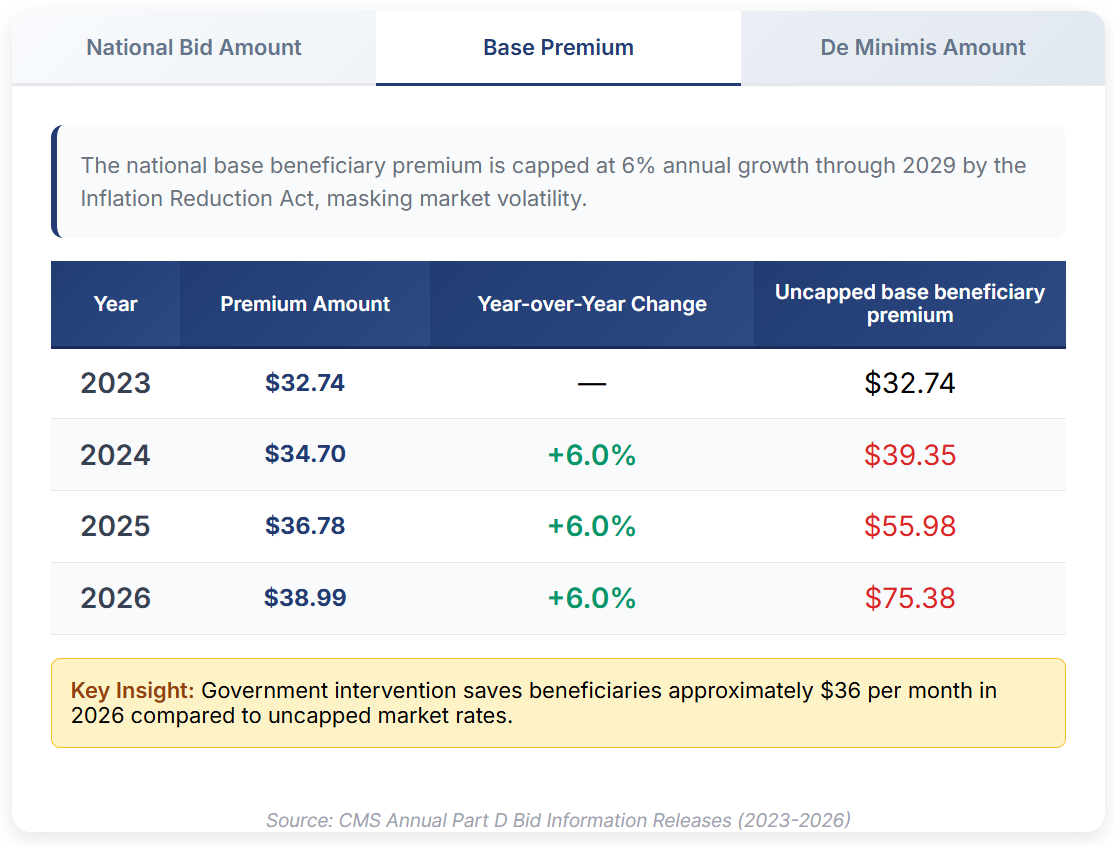

| Year | Premium Amount | Year-over-Year Change | Uncapped base beneficiary premium |

|---|---|---|---|

| 2023 | $32.74 | — | $32.74 |

| 2024 | $34.70 | +6.0% | $39.35 |

| 2025 | $36.78 | +6.0% | $55.98 |

| 2026 | $38.99 | +6.0% | $75.38 |

| Year | De Minimis Amount | Change | Plan Participation |

|---|---|---|---|

| 2023 | $2.00 | No Change | Voluntary |

| 2024 | $2.00 | No Change | Voluntary |

| 2025 | $2.00 | No Change | Voluntary |

| 2026 | $2.00 | No Change | Voluntary |

On July 28, 2025, the Centers for Medicare and Medicaid Services released three key figures that provide insight into the state of the Medicare Part D market. Spoiler: It's not pretty. But being able to explain why things aren't looking so great will help you better educate your beneficiaries about what they'll experience when shopping for plans during AEP.

So, here's your complimentary crash course on the 2026 Medicare Part D Market.

We can't dive into Part D premium trends without knowing how a Part D premium is calculated. The process involves several moving pieces that agents rarely see but that directly impact what clients pay.

It starts with each plan's bid to CMS— what the carrier estimates it will cost to provide basic Part D benefits to an average beneficiary. These individual plan bids get rolled up into the national average monthly bid amount, which serves as the benchmark for the entire program.

From this national benchmark, CMS calculates the base beneficiary premium—the standard amount all Part D enrollees would pay if the program operated like a simple insurance pool. However, beneficiaries don't necessarily pay this base amount. Instead, they pay their specific plan's premium, which can be higher or lower than the base depending on the plan's individual bid in that service area.

From here, the premium is calculated by adding the difference between the plan's bid and the national average bid to the base premium.

If only it were that simple.

The government then provides subsidies to keep premiums affordable, risk-adjusts payments based on enrollee health status, and applies various policy interventions to fit its goals. Plans also factor in their expected administrative costs, profit margins, and of course, their exposure to prescription drug costs.

Even more factors can muddy the waters: geographic adjustments for regional cost differences, late enrollment penalties for beneficiaries who delayed coverage, and Income-Related Monthly Adjustment Amounts (IRMAA) for higher-income beneficiaries.

And so, market forces, government policy, and individual plan design will all impact what your client pays for a Part D plan.

Your eyes aren't deceiving you. This key figure has grown by nearly six times in the past four years. But what does that increase mean?

The National Average Monthly Bid Amount (NAMBA) represents what all Part D plans nationwide bid to provide the basic Part D benefit to Medicare beneficiaries. Think of it as the wholesale cost of drug coverage before government subsidies, risk adjustments, and individual plan variations and benefit strategies come into play.

For years, the bid amount moved predictably. In CY2023, the last year before provisions of the Inflation Reduction Act of 2022 went into effect, plans bid an average amount of $34.71 per month. That figure had grown steadily but moderately over the history of Medicare Part D.

But then, the Inflation Reduction Act happened.

In 2024, the NAMBA jumped to $64.28. In 2025, it reached $179.45. And in the just-released memo. CMS revealed the 2026 figure: $239.27. That's an increase of 589% between 2023 and 2026.

What's to blame? Increased utilization and more expensive drugs each play a role here. But the lion's share of the blame has to go to the Part D redesign implemented under the Inflation Reduction Act.

Under the Act, Part D plans now absorb 60% of catastrophic coverage costs, up from the previous 20%. Previously, when a beneficiary's costs exceeded the catastrophic coverage threshold, Medicare picked up most of the tab. Now, plans are on the hook for the majority of those high-cost scenarios.

For health insurance agents, this explains the increase in Part D deductibles, more limited plan options, and why carriers have exited certain markets. It also sheds light on some carriers' decisions to change commission payouts mid-year. Their actuaries are pricing in the reality that they bear much more responsibility for members with expensive and/or extensive prescription needs -- costs that can easily reach tens of thousands of dollars per member for conditions like cancer or multiple sclerosis.

You probably know the national base beneficiary premium (NBBP) by its role in calculating the Part D late enrollment penalty. It figures into several other calculations, too. But it also adds another piece to our puzzle.

The NBBP represents an average of all Part D premiums nationwide. Since it's an average, of course, plans may charge more or less than this amount. How is it possible that it's only increasing 6% when the bid amounts have increased so drastically?

Enter the Inflation Reduction Act. Again.

That Congress, knowing that redistribution of financial burdens would drive up bids and premium costs, placed a 6% cap on increases to the national base beneficiary premium. So, while the NAMBA has increased 539% over the past four years, the national beneficiary premium has only risen 19% over the same time frame.

However, the law also requires CMS to publish what the NPPB would have been without that 6% cap -- and the difference is staggering. In 2024, it would have been $39.35. In 2025, when carriers first assumed more responsibility, it jumped to $55.98. And for contract year 2026, we'll see an increase to $75.38.

Part D premiums remain (relatively) stable due to this provision -- they're not going up nearly as much as they could or should in an unregulated market -- but this artificial measure impacts what plans can charge a beneficiary. And, it sheds more light on why plans are adding deductibles and re-shaping their formularies: even amongst a variety of subsidies and other programs, their income doesn't quite match their costs. Benefits get leaner as a result.

One thing has remained constant over these four years: the Medicare Part D de minimis amount.

In short, the law allows Part D plans to, voluntarily, waive a portion of a Part D enrollee's monthly premium that is above the low-income subsidy (LIS) benchmark. If the plan waives this amount, LIS-eligibles may enroll in the plan and either pay a reduced premium or potentially no premium for prescription drug coverage. In short, if a plan's premium is no more than $2 above the LIS benchmark, it can choose to waive that amount for LIS beneficiaries.

Carriers opting in to this program is actually a good thing, at least when looking at the social goals of Medicare. It means that, despite absorbing hundreds of millions more in additional catastrophic costs, carriers are still honoring a commitment to some of your most vulnerable beneficiaries. That's a helpful talking point when you're assisting those who are LIS-eligible.

To put it gently, the Medicare Part D market is in transition.

The massive increases in bid amounts reflect real cost pressures that carriers will be battling for the foreseeable future. The cap on the national beneficiary base premium increases creates some artificial stability in the market -- but the long-term consequences are untold. Government subsidies help make up the difference between claims and expenses, but this arrangement only lasts through 2029. After that, either premiums will need to rise even more significantly, or Congress will need to extend or change its intervention.

All that said, here's what you'll need to watch out for this year:

Client education becomes critical: Beneficiaries may not understand why plan options change, why certain drugs face restrictions, or why their Part D deductible keeps climbing. The underlying financial pressures aren't visible in their monthly bills, but they drive every other aspect of plan design.

Utilization management will have to play a role: As plans absorb more costs, you can expect to see more attempts to manage high-cost drug usage. Things like prior authorizations, step therapy, and formulary redesign are all on the table. While enrollees should evaluate their plan selection every year, your clients with high drug costs will need to examine their options with a careful eye.

Carriers will reshape their offerings: Not all plans will be able to stomach the increased costs. And if they do, it won't be in equal measure. Expect changes in plan design, reduction in service areas, or even full market exits. The plans your clients have in 2025 certainly won't look the same in 2026, making now as good a time as any to consider expanding your Part D portfolio.

In short, the Medicare Part D Market of 2026 is not the same market that existed even three years ago. The data here reveal a market adapting to a redistribution of risk and government intervention. Agents who understand these dynamics will be better positioned to guide clients through another tough enrollment season.

2 min read

The plans, they are a changin’ The Medicare Advantage market has been shaken up all across the country, but particularly so in Michigan, and even...

2 min read

The 2022 Inflation Reduction Act kickstarted a long series of changes to Medicare Part D. Implementation of that redesign continues in contract year...

4 min read

You’ve scheduled an event at your local senior center. You’ve filed your formal marketing event with the carrier and CMS. The presentation is all...